Fsa Limit 2025 Family. For 2025, the minimum deductible for a family health plan will be at least $3,200, up from $3,000 in 2025. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

The 2025 health fsa limits increase contribution amounts for employee benefit plans. But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025).

The adjustment for 2025 represents a $150 increase to the current $3,050 health fsa salary reduction contribution limit in 2025.

Fsa Limits 2025 Carryover Limit Nyssa Arabelle, We are providing a table below of 2025 indexed benefit limits we have seen published so far. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Irs Fsa Max 2025 Joan Ronica, A rollover limit is a cap on any unused. Fsas only have one limit for individual and family health.

What You Need to Know About the Updated 2025 Health FSA Limit DSP, The adjustment for 2025 represents a $150 increase to the current $3,050 health fsa salary reduction contribution limit in 2025. An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

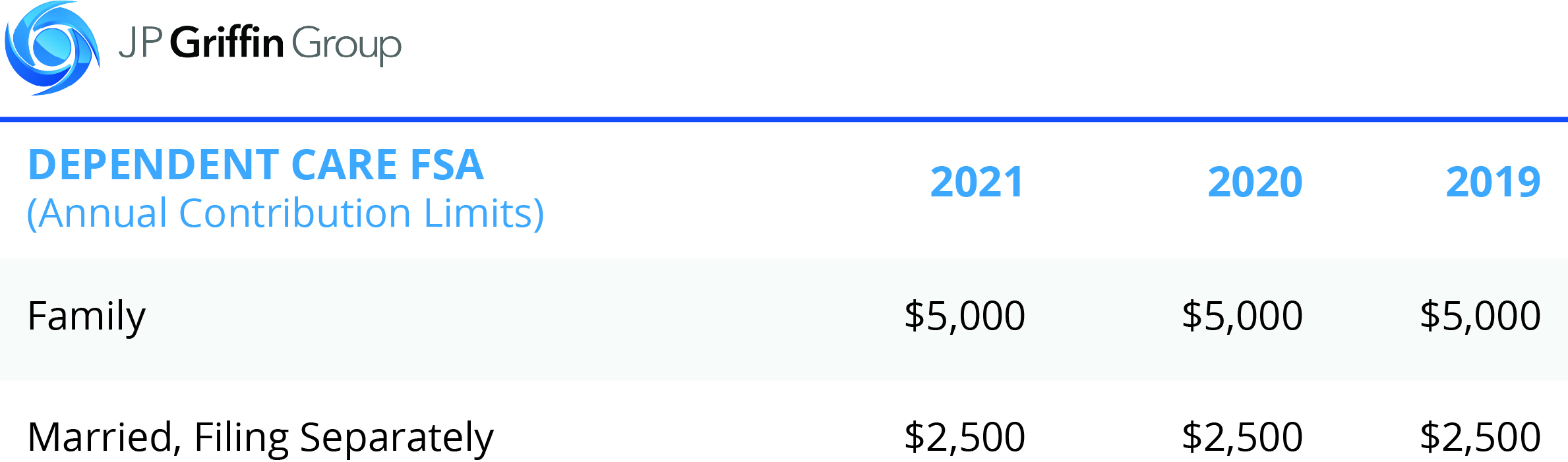

Fsa Annual Limits 2025 Manon Christen, What is the dependent care fsa limit for 2025? On november 10, via rev.

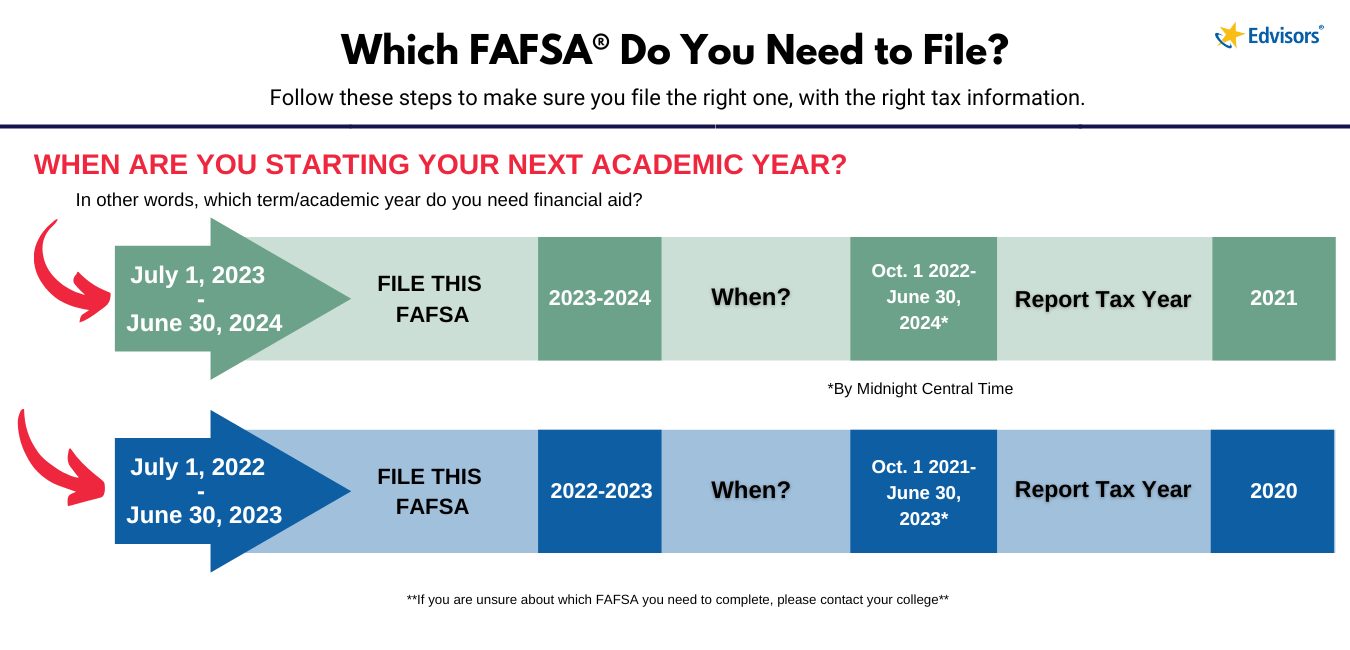

When To Complete Fafsa For Summer 2025 Riane Chiquita, On november 10, via rev. The 2025 fsa contributions limit has been raised to $3,200 for employee contributions (compared to $3,050 in 2025).

Irs Dependent Care Fsa 2025 Jayme Loralie, A rollover limit is a cap on any unused. We are providing a table below of 2025 indexed benefit limits we have seen published so far.

What Is The 2025 Fsa Limit Lynne Konstance, For 2025, the health fsa contribution limit is $3,200, up from $3,050 in 2025. As health plan sponsors navigate the open enrollment season, it’s.

Irs Dependent Care Fsa Limits 2025 Nissa Leland, Fsa contribution limits cap the. Fsas only have one limit for individual and family health.

.png)

Has Irs Announced Fsa Limits For 2025 Jojo Roslyn, Fsa contribution limits cap the. Fsas only have one limit for individual and family health.

List Of Fsa Eligible Expenses 2025 Irs Honey Laurena, But if you have an fsa in 2025, here are the maximum amounts you can contribute for 2025 (tax returns normally filed in 2025). An employee who chooses to participate in an fsa can contribute up to $3,200 through payroll deductions during the 2025 plan year.

Each employee may only elect up to $3,200 in salary reductions in 2025, regardless of whether he or she has family members who benefit from the funds in that.