Magi Brackets For 2025. Modified adjusted gross income (magi) part b monthly premium amount prescription drug coverage monthly premium amount; With the announcement of the august.

Can i appeal the determination? Modified adjusted gross income (magi) part b monthly premium amount prescription drug coverage monthly premium amount;

The below charts outline roth ira contribution limits for tax year 2025 (taxes filed in 2025) and limits for tax year 2025 (taxes filed in 2025).

What Is Medicare Part B Irmaa 2025 Evey Oneida, Understanding your adjusted gross income (agi) and modified adjusted gross income (magi) is key to predicting your medicare premiums for 2025. On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and part.

That 28,000,000 Tax HumbleDollar, · how is it calculated? Amounts and how to forecast for retirement.

Medicare Cost 2025 Part B Premium and Deductible Decrease Bob’s, · how is it calculated? Thefinancebuff.com website estimates that the 2025 single lowest bracket for 2025.

Medicare Blog Moorestown, Cranford NJ, · how is it calculated? Whether you must pay an irmaa in 2025 depends on your 2025 tax returns.

Irmaa Tables For 2025 Maura Nannie, Modified adjusted gross income (magi) part b monthly premium amount prescription drug coverage monthly premium amount; If you file taxes as a single person, your modified adjusted gross income (magi) must be under $153,000 for tax year 2025 and $161,000 for tax year 2025 to contribute to a roth.

.png)

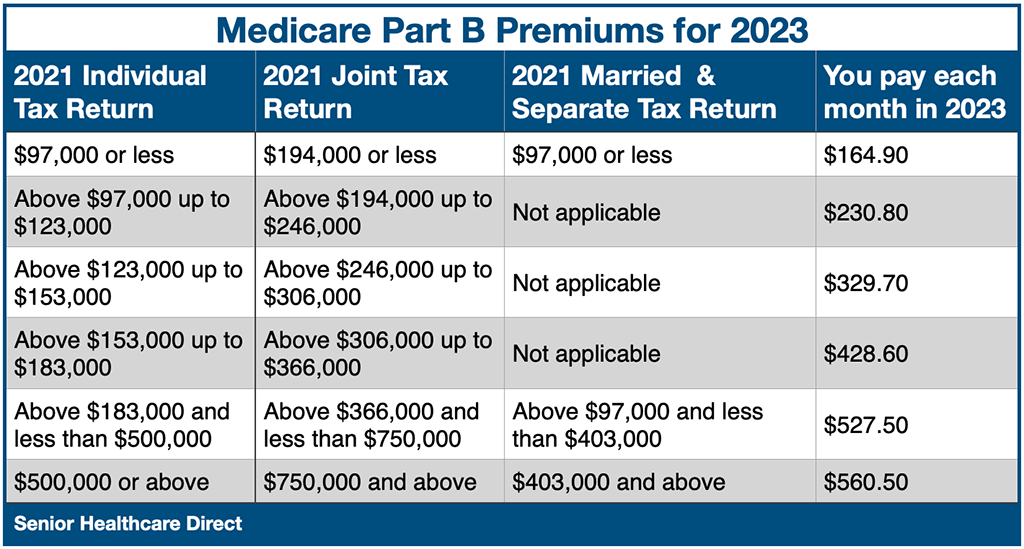

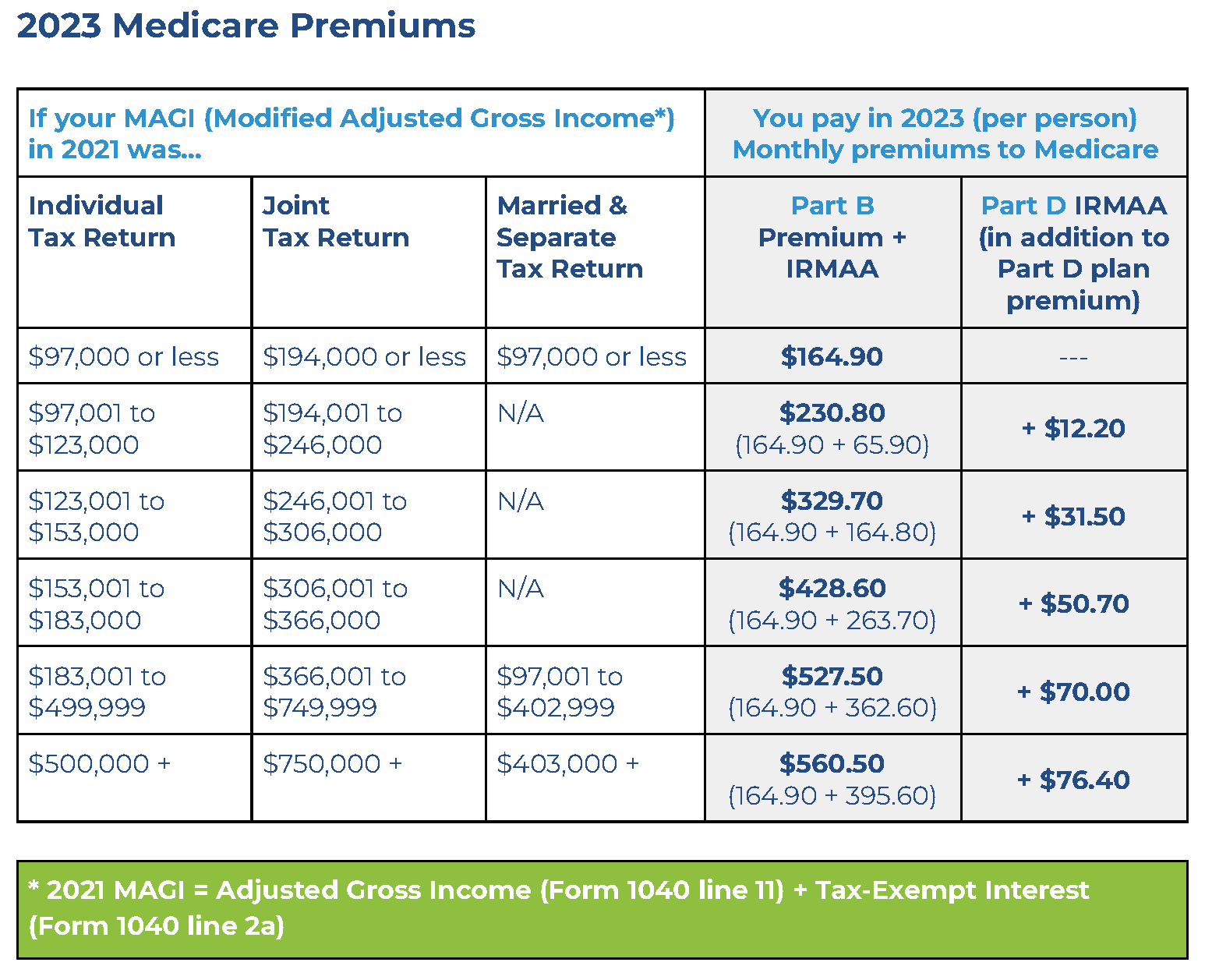

Why Filing Taxes Separately Could Be A Big Mistake (when on Medicare, For 2025, the part b premium is $174.70 and the part d is $55.50. Income brackets and surcharge amounts for part b and part d irmaa.

Irmaa 2025 Form Printable Forms Free Online, Dan mcgrath april 1, 20248 min read. Generally, the information is from two years prior to the year for which the premium is being determined, but not more than three years prior.

Medicare a bigger piece of retirement planning for advisers, Understanding your adjusted gross income (agi) and modified adjusted gross income (magi) is key to predicting your medicare premiums for 2025. A total of 12 teams will compete in a.

Tax Filing 2025 Usa Latest News Update, On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and part. Income brackets and surcharge amounts for part b and part d irmaa.

What IRMAA bracket estimate are you using for 2025? (2025), The role of modified adjusted gross income (magi) irmaa brackets 2025. This page features a 2025 obamacare eligibility chart, the 2025 federal poverty level used for 2025 subsidies, and a subsidy calculator.

On october 12, 2025, the centers for medicare & medicaid services (cms) released the 2025 premiums, deductibles, and coinsurance amounts for the medicare part a and part.